The change of seasons can leave us with an urge to make changes in our lives. January is when many of us make resolutions and commitments. Spring is when we throw open our windows, clean out our closets and look forward to the long sunny days ahead. Fall has always been an important season for me. It goes back to my school days—getting ready for another year with new clothes and school supplies, getting back to old routines and old friends.

Smart people apply this same approach to their money

Paying off outstanding balances and starting the year without debt can be a great way to start a new year. Here are a few things you can do give your finances a housecleaning.

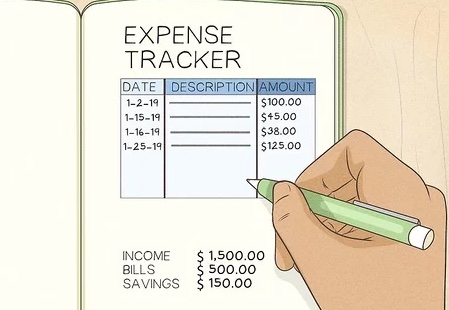

1. Financial management starts with getting your finances organized

There’s no way you can stay on top of your finances if you don’t have a system in place for budgeting.

If you think you know about how much you’re earning and how much your spending and don’t need to do this, forget it. That won’t fly. It’s only by tracking your spending vs your income that you will understand where your money goes. This information will drive your budget.

You can create a budget on paper, in an Excel spreadsheet or in budgeting software. According to Forbes, these are 2024’s best budgeting apps:

Best Budgeting App For Achieving Financial Goals

- Empower Personal Dashboard™: Best Budgeting App For Investors

- Goodbudget: Best Budget App For Budgeting Using Envelopes

- Oportun (formerly Digit): Best Budget App For Passive Saving And Investing

- PocketGuard: Best Budgeting App For Tracking Spending

- Stash: Best Budget App For Getting Started With Investing

- Honeydue: Best Budgeting App For Couples

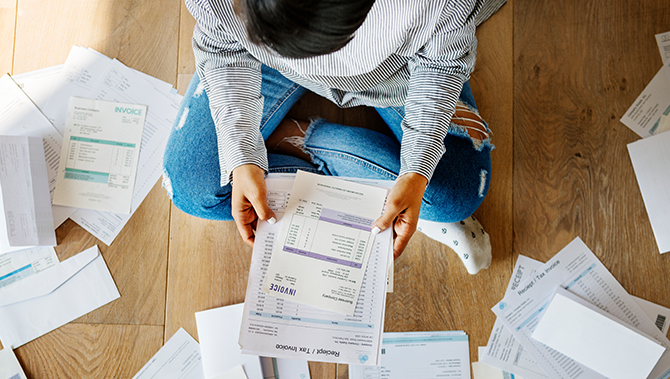

2. Shred the paper-based bills

Even though I’m set up with online banking and autopay, paper always seems to materialize! It makes me nuts, and I know I’m not alone. Even though I log into my accounts and choose the “Go paperless” option, I still get mail from my bank and Xfinity who are constantly trying to sell me their latest offerings in which I’m not interested.

Yes, we do need to keep some financial documents, but we can toss most of them. Here’s a good article, again from Forbes, about what to keep and what to toss, Financial Documents: What To Save And What You Can Throw Away

3. Check your credit card statement and online accounts regularly

Failing to be vigilant with credit card statements can be ugly, and I see this kind of thing often. My client, Cindy, had purchased some skincare products and discovered about a year later that she was being charged $30 a month for their special “program”, which she never signed up for in the first place! She never even received product after the first month. She wasted $360 by ignoring her billing statements.

This is an election year, so be aware of this one, which can be so easy to miss

If you make a donation, make sure you’re checking the tiny box for “one-time donation” rather than “monthly donation” unless, of course, you want to donate monthly. It’s easy to miss this, so review your accounts. Cancel or question anything that shouldn’t be there.

Subscriptions, memberships or contracts can automatically renew without our realizing it. And, excuse my cynicism, but it’s intentional with some companies. Reviewing your bank statement on a regular basis should be part of strategic financial planning. It’s way too easy to miss this kind of thing.

4. Review monthly expenses

I know it’s the biggest pain ever to get on the phone with internet, phone and other service providers (Makes me want to scream!) But, generally, you can save money by checking statements for errors, asking for promotional rates, changing your plans or all of the above.

You might sacrifice an hour to frustration but it’s worth it

If you save $25 a month, that’s $300 hr. for your time! Well worth it. The last time I forced myself to suffer through this process, I managed to save a total of $50 month. I much rather have that $600 in my pocket than AT&T’s or Verizon’s!

Put a little elbow grease into cleaning up your finances and you’ll be surprised at how good they look! Eliminating or paying down debt is part of learning to live within your means.