We think there’s always plenty of time to create a living trust and a will. Plenty of time to organize our legal documents, update our login information and make sure we’ve identified our heirs. But sometimes there’s not time. We don’t know what’s going to happen to us or our families. Many families these days are caring for aging parents, even as they are trying to figure out their own retirement. Learning how to create a living trust should be part of long-term planning. Include a living trust as part of your financial management tools.

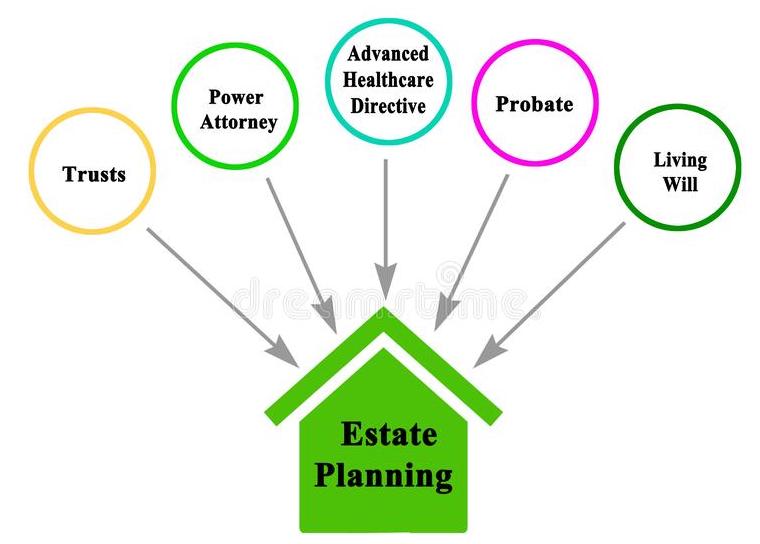

Creating legal documents that detail exactly how you wish to distribute your estate are a critical part of long-term planning.

A personal plea for long-term planning based on my own unexpected loss

Last month, my father-in-law died suddenly; soon after, a close friend’s brother died instantly in a terrible accident. Neither had their affairs in order—no will or trust. No legal documents outlining how their estate would be distributed. The sad truth is that each, certainly not intentionally, left an inconceivable mess for their grieving families.

So what happens when there are no legal documents?

At a time when you’ll be mourning the loss of a loved one, you’ll be faced with trying to unravel the puzzle of your loved one’s life. The following is an end-of-life checklist.

- Where are important papers kept, if there are important papers

- Is there a will, If so, where is the will? More important, is there a living trust? If not, that means you’ll be dealing with probate

- Financial accounts: What money is there, where are the bank accounts and how to access them to pay bills?

- Is there a power of attorney, and if so, who is it?

- What about insurance, pensions, retirement accounts, beneficiaries, vehicle titles, mortgage information, online passwords and myriad other matters.

- This one is could be a dealbreaker–you really should have login information to online accounts. What if you were incapacitated and your family needed to access your accounts for critical information or funds, this could become critical.

A task that will be expensive, both emotionally and financially.

My father-in-law didn’t complete a healthcare directive or Power of attorney. So end-of life decisions were complex and distressing for the family. No one had access to his finances for the expenses that were coming up. The reality is that dying can get expensive.

The father-in-law had great qualities, but he also had a stubborn depression-era mentality—he had became a bit of a hoarder. He kept everything–I mean everything! While he had some documents in order, the efforts to find all financial and legal records have been difficult. It will take an enormous amount of time and effort to finish this task. His children have to do this while grieving the loss of a parent they loved.

For my friend who lost a brother in an accident, there were no instructions, just a chaotic house filled with stuff

They’ve not been able to find a will or trust, no legal or financial documents. There are three vehicles, but no keys and no titles have been found. There are business obligations, and who knows what else–and that’s the point. Who knows what else? That’s the tip of the iceberg. It’s horrible for my friend and her family.

Clearly, nobody would intentionally make things this hard for their families if they had a choice. But the point is, we have a choice.

GET YOUR AFFAIRS IN ORDER. NOW!

Create a living trust. If your estate is complicated, you need an attorney. If it’s very simple, you can DIY. There is another solution—legal document preparer companies throughout the area. They work with you and create the legal documents. Their fees are significantly lower than those of an attorney. You can do this virtually or in-person.

Organize your important documents

You’ll need financial and insurance records. Keep these organized on an ongoing basis. Initiate ongoing conversations with family members to discuss important issues. These are tough conversations that none of us wants to have, but they are necessary and you feel surprisingly good after having them! Your family needs to know what to do if you should die unexpectedly. Make it easy for them.

There are many sources of information to get you organized

- CitizenInformation.ie, explains what happens to your money and property when you die.

- A legal document preparer in the Bay Area, Guideway Legal

- How to create a living trust

If you truly care about your family, I urge you to take these steps. Trust me, you don’t want to leave your family with such a complicated mess. They deserve more, and so do you.