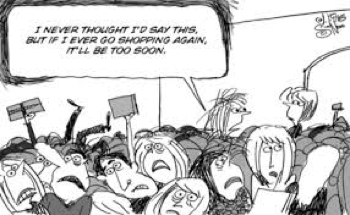

Does holiday spending stress you out?

Do you find yourself spending in ways you really don’t want? Have you lost the joy of celebrating? Are you overwhelmed by your credit card bills once the holiday spending madness has diminished?

If so, perhaps it’s time to stop.

Really.

Stop.

As a money coach, I often see my client’s desire of simple joy for the holidays hijacked by obligation and overspending. And let’s not forget the “only today on sale great deals”! Maybe you’ve already explored ways to economize: you draw names, shop early, catch the sales, or buy in bulk. But I’m suggesting you make a bigger leap. Go beyond just finding cheaper ways to buy more stuff. Learn to truly enjoy the holidays, while also protecting your financial health.

Here’s how:

1. Seriously evaluate what the holidays mean to you. Ask yourself some hard questions. What if there were no expectations of you for the holidays? Then how would you honestly wish to celebrate the season? Would you still want to buy gifts? If so, for whom, and why? And how much can you realistically afford to spend on gifts and parties right now? You don’t have to let our consumer culture dictate how you express love and create connection. Here are some experiences of people rethinking gift giving.

2. Get clear on subconscious beliefs and emotions that may be sabotaging your financial health. A little introspection can go a long way. What is really driving your decisions? You can get a helpful worksheet regarding money beliefs on my website. Emily and Josh had $45,000 in credit card debt when they first came to see me. During our holiday budget planning session, Josh revealed he’d feel guilty if they cut back on gifts for the kids. Exploring further, Josh realized that his own father had used money as the primary way to connect to his children. Even though Josh was a loving Dad, he had the belief that love equals things. With trepidation, Josh discussed gift ideas with his children. To his surprise, they suggested a family fun day instead of gifts! One daughter wanted to go to the movies together; the other daughter wanted a family bake day. They did both, and it was a memorable and happy day with minimal holiday spending expense.

3. Respect peoples’ differences, including your own. If your friend wants to throw an extravagant party with expensive gifts, you don’t have to try to talk them out of it. But you also don’t have to reciprocate in kind. Your idea for a holiday gathering might be a potluck followed by a hike. Have the courage to be true to your own values and your own financial health.

4. Create new traditions. Traditions are familiar repeated practices that can give a sense of belonging. But they also might get you stuck in a rut. What about creating some new traditions this year, ones that don’t put wear streaks on your credit cards? For example, instead of buying new gifts, my client Jackie’s family staged a “white elephant” holiday party that turned out to be a great fun. Now they look forward to doing this every year.

5. Resolve to come from a place of financial health. Credit.com reports that almost 14 million Americans began this year saddled with debt from last holiday season. You can decide not to be part of that statistic this year. Remember, the best gift you can give yourself and your family is the gift of financial health all year long.